SEC employs a distinctive approach that combines business and social functions to create a highly efficient and effective social entrepreneurship organization. Keeping in line with recent business trends, we emphasize the outsourcing of most of our business activities. It’s important to note that when we refer to outsourcing, there are no negative consequences such as job losses or social disruptions. On the contrary, this approach leads to the generation of social wealth through collaborations with SEC’s numerous partners in the corporate and social sectors, who will be responsible for developing and implementing individual social entrepreneurial (SE) projects.

The activities delegated to our partners will primarily include:

- Research and Client Prospecting: Identifying potential corporate clients.

- Consulting Services: Providing advisory services to both public and private corporations, as well as non-profit clients.

- Value Consulting: Offering advice to private and public investors on value-driven strategies.

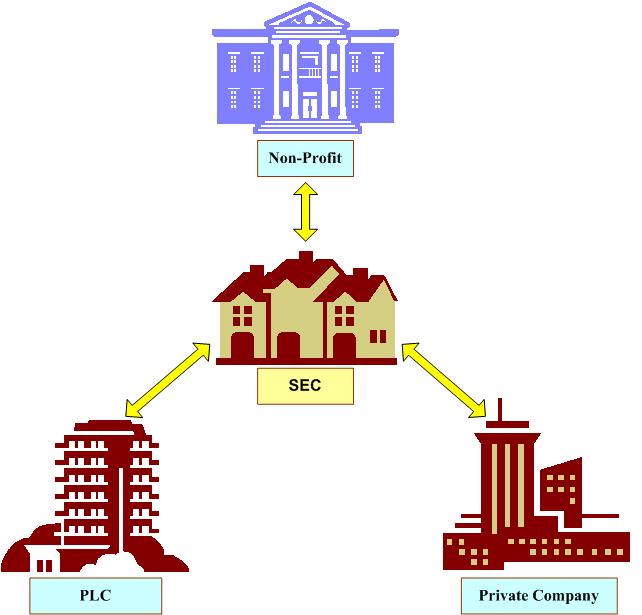

As a dynamic organization, SEC functions as a thriving network of collaborating enterprises. These enterprises work together on SE projects and programs initiated by SEC. We act as a bridge connecting the corporate and non-profit realms (see Figure 1). While these two worlds do not directly intersect, SEC engages with both publicly listed companies (PLCs) and private unlisted companies to realize capital gains. These gains are then reinvested to provide much-needed funding to non-profit organizations, accompanied by essential business mentoring and support. With SEC’s guidance, non-profit organizations become self-sustaining entities.

What sets SEC apart is its uniqueness in the field of social entrepreneurship. We are on track to become the largest global social entrepreneurship fund and knowledge provider, contributing a wealth of assets, including conceptual, intellectual, entrepreneurial, social, and philanthropic capital.